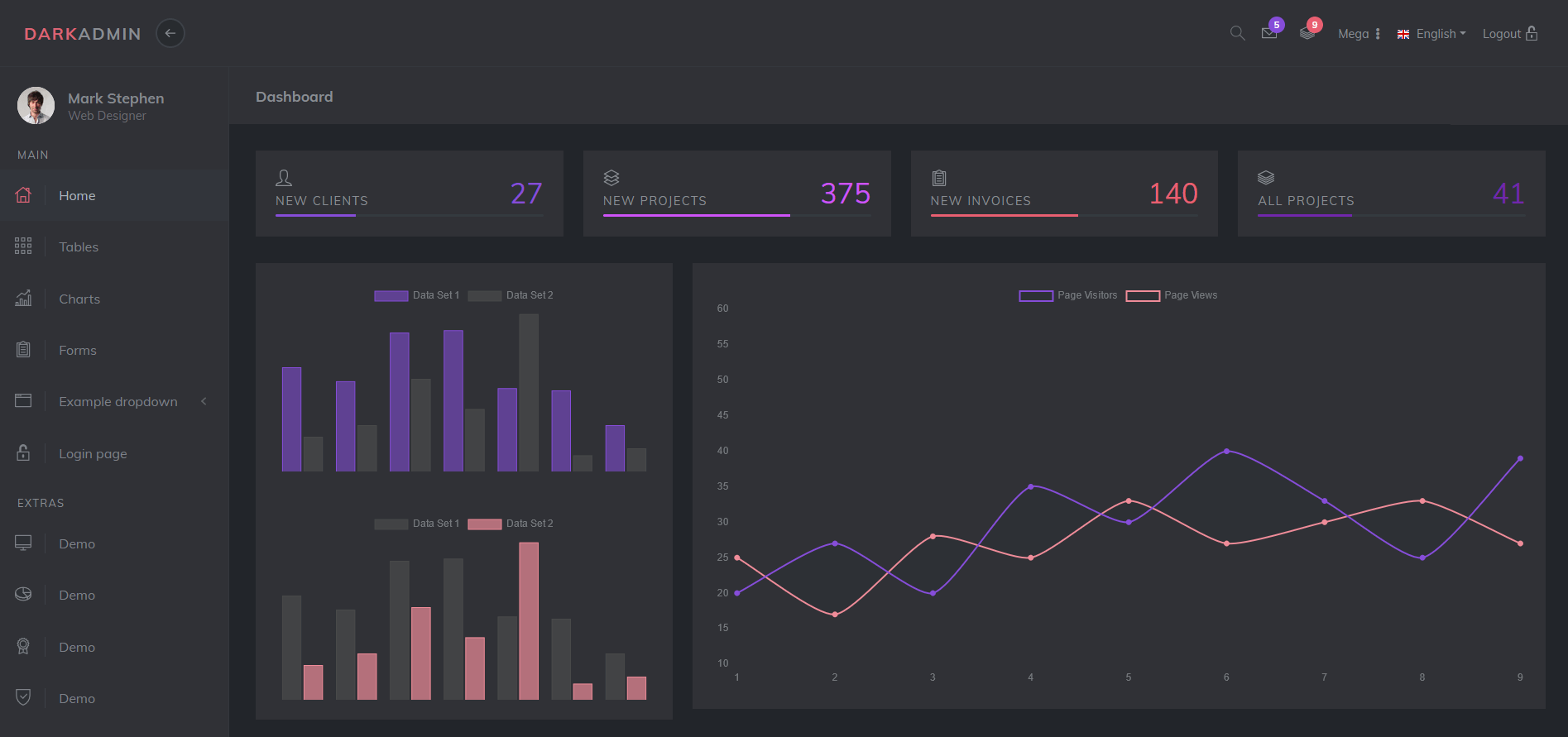

KNOW YOUR EXPOSURE

The Delegated Authority Analytics platform for insurers and MGAs

Luna enhances policy data and provides powerful insights with modern analytics tools.

Unprecedented Insight into Delegated Authority Business

Stop waiting for outdated reports to understand performance and risk across a delegated authority portfolio. Luna delivers granular, real-time data directly from policy transactions as they occur.

- Access detailed metrics previously unavailable, such as exclusion and endorsement usage

- Track critical policy elements, like peril-specific deductibles

- Gain immediate visibility into portfolio composition, limits stacks, and emerging risk trends

Fast Activation of Full Visibility

Transitioning to modern data oversight is faster and simpler than you think. Luna integrates seamlessly with minimal implementation.

- Achieve immediate value and rapid return on investment with minimal operational impact

- Utilize a straightforward setup process designed for rapid deployment across MGA networks

- Go live within a week, bypassing lengthy IT projects and complex integration delays

Security & Compliance at the Forefront

Protecting sensitive policyholder information and ensuring regulatory adherence are paramount. Luna is built on a foundation of cutting-edge security architecture and strict compliance protocols.

Have any questions?

Frequently Asked Questions

What exactly does Luna provide?

Luna delivers real-time, detailed data extracted directly from policy documents transacted by your MGAs under delegated authority. This provides carriers with unprecedented visibility into portfolio performance and risk as it happens.

How does Luna integrate with our MGAs' processes?

Luna integrates seamlessly, requiring only a minor adjustment to your MGAs’ standard document issuance workflow. There are no complex system changes needed on the MGA side, ensuring smooth adoption.

What kind of insights can we gain from Luna's data?

You can access highly granular data points often missed in traditional reporting, such as detailed deductible structures analyzed by peril, specific exclusion usage tracking, limit concentrations, and real-time premium flows, enabling more sophisticated analysis.

How quickly can we be operational with Luna?

Implementation is exceptionally fast. Carriers can typically gain full visibility and access to Luna's real-time data within just a week of the straightforward setup completion with their MGA partners.

How does Luna ensure data security and compliance?

Protecting your data is our top priority. Luna utilizes cutting-edge security architecture and protocols throughout the data handling process and is fully compliant with GDPR regulations for data protection.

Does Luna require integration with our core policy admin systems?

No direct integration with your core PAS or other internal carrier systems is typically required for Luna's core functionality. Luna operates efficiently to provide its data insights, minimizing IT resource requirements on your end.

How is Luna different from traditional MGA bordereaux reporting?

While bordereauxs provide periodic snapshots, Luna offers continuous, real-time data extraction directly from source documents as they are issued. This eliminates reporting lags and provides far more granular detail than standard bordereaux formats typically allow.